New Research Shows Eight Major Banks Responsible for Majority of $20 Billion in Financing For Oil And Gas Companies Destroying the Amazon

July 25, 2023

https://stand.earth/press-releases/title-new-research-shows-eight-major-banks-responsible-for-majority-of-20-billion-in-financing-for-oil-and-gas-companies-destroying-the-amazon/

Oil and gas financing report exposes eight major banks’ complicity in Amazon rainforest destruction

Belem, Brazil, July 25, 2023: Eight major U.S., European and Brazilian banks are fueling Amazon and climate destruction, by providing the bulk of financing for the oil and gas sector in deals directly traced to activities in Peru, Colombia, Brazil and Ecuador, according to research released today by Stand.earth and the Coordinator of Indigenous Organizations of the Amazon Basin (COICA), ahead of next month’s Amazon summit in Belem.

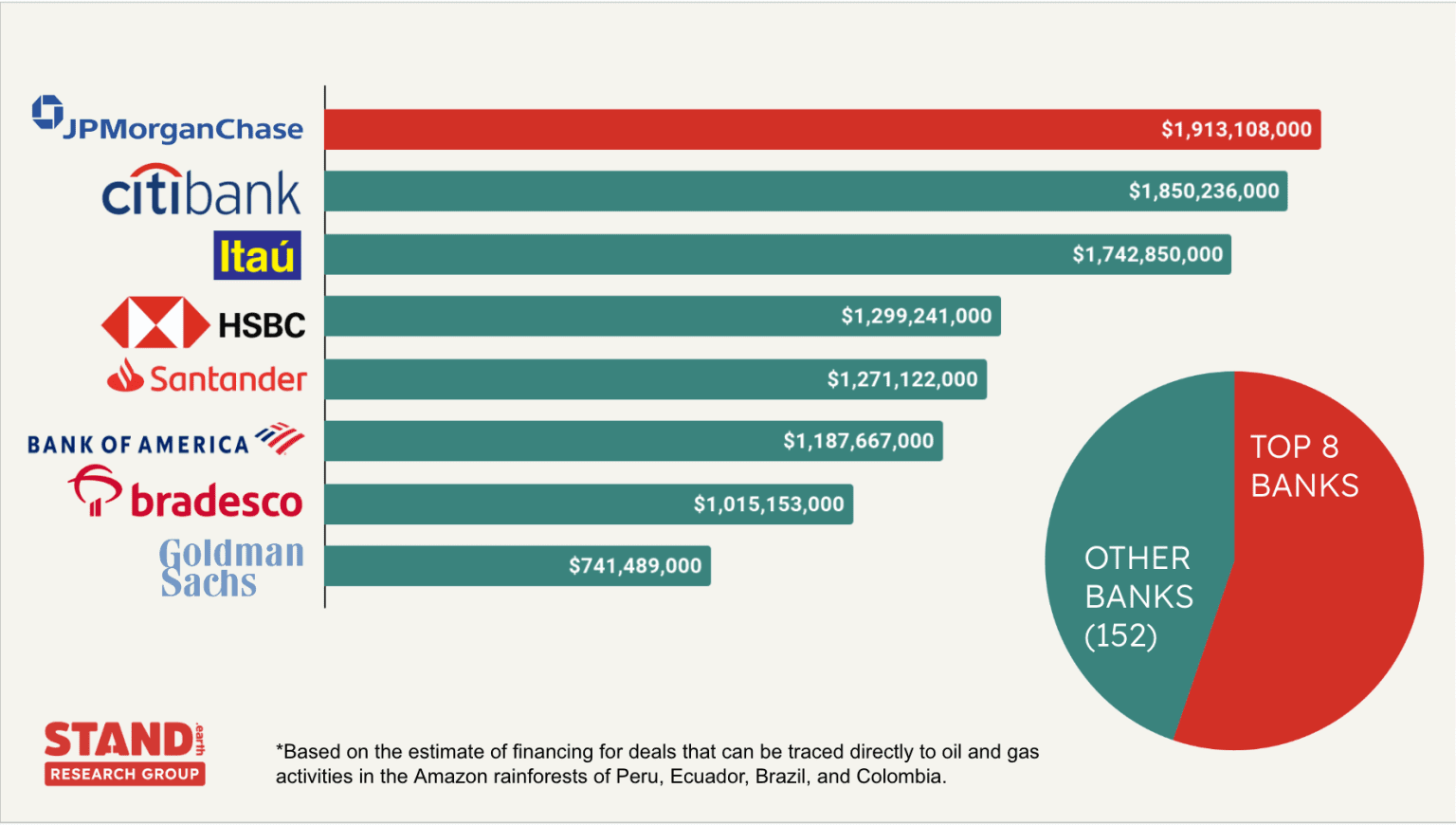

Capitalizing on Collapse, the report authored by award-winning researchers at Stand.earth Research Group, details how JPMorgan Chase, Itaú Unibanco, Citibank, HSBC, Banco Santander, Bank of America, Banco Bradesco, and Goldman Sachs provided over $11 billion USD in financing to Amazon oil and gas activities over the past 15 years, from 2009 – 2023. These banks are responsible for 55% of the estimated $20 billion USD total that can be traced directly to the region, while making up just 5% of the banks in the database. Of the eight banks, six are either headquartered in the US or act through their US subsidiary and operate in deals across the region, while two Brazilian banks- Itaú Unibanco and Banco Bradesco – are highly connected to specific oil and gas projects in that country.

Figure 1. The top 8 banks are 55% of estimated direct financing over the past 15 years, but only 5% of banks in the database. JPMorgan Chase tops the list for Amazon destruction with 10% of the direct financing, or 1.9 billion USD.

Banks such as JPMorgan Chase, who top the list with 10% of direct financing (1.9 billion USD), have profited from financing oil and gas over the past 15 years despite the fact that the threat of an Amazon collapse has increased dramatically over the same time period. The rainforest has been fragmented, deforested, and burned to the point that scientists are warning it could be crossing a disastrous ecological tipping point. Decades of flaring and oil spills related to the oil and gas industry have polluted Amazonia waterways and soil, making Indigenous communities sick, reducing their livelihoods, and violating their rights. And as financing has created new opportunities for expansion, the industry has pumped carbon emissions into the atmosphere at the cost of a climate-safe future.

Case studies included in Capitalizing on Collapse illustrate how each of these top banks has been involved in deals that expand oil and gas production in the Amazon, including involvement in the development of Amazonia’s biggest carbon bomb, the Parnaiba Gas Complex, which is capable of releasing two gigatons of carbon in its lifetime. According to the International Energy Agency, such expansion is not compatible with keeping global warming under control, despite bank climate commitments claiming to align with a 1.5C pathway.

Capitalizing on Collapse also casts light on the banks that finance companies involved in Amazon oil and gas where the money is harder to trace – known as indirect financing. The report explores how opaqueness in financial data and weakness in bank environmental and social risk (ESR) policies can create conditions for financing to flow to fossil fuel production, even as banks make explicit climate, human rights, and biodiversity commitments.

As government leaders meet in Belem at Brazilian President Luiz Inácio Lula da Silva’s Amazon Summit on Aug. 8 to 9 to discuss how to protect the region, uplift Indigenous leadership, and protect environmental values, Capitalizing on Collapse demonstrates that banks have a key role to play in the future, rather than the destruction, of the Amazon. The Indigenous-led regional protection initiative, Amazonia for Life: Protect 80% by 2025, also names stopping fossil fuel investment as a key plank for the initiative’s success, while the final resolutions from the UN Permanent Forum on Indigenous Issues also urge Amazonian states to protect 80% by 2025.

Some banks have stepped up to tackle their complicity in Amazon destruction. In May 2022, BNP Paribas pledged to no longer finance or invest in companies producing from oil and gas reserves in the Amazon or developing related infrastructure, becoming the first major bank to adopt a geographical exclusion of oil and gas from the Amazon rainforest. In December 2022, HSBC amended their policies to exclude all new finance and advisory services for any client for oil and gas project exploration, appraisal, development, and production in the Amazon Biome. These two banks, along with some others, are sending important signals that banks should be willing to review their relationship to Amazon destruction and take steps to manage that risk.

The report is accompanied by a first-of-its-kind searchable public database of all the banks involved in Amazon oil and gas through directly traceable and indirect financing. The Amazon Banks Database builds on Stand Research Group’s earlier research on trade financing and bank ESR policies. The database is a comprehensive list of the banks involved in loan and bond underwriting deals for companies engaged in upstream and midstream development and transport of oil and gas in Amazonia. The Amazon Banks Database will be publicly available at Exit Amazon Oil and Gas by July 25th.

Angeline Robertson, Lead Researcher, Stand Research Group:

“This award-winning research highlights that banks have a critical role to play in shifting the energy economics behind the climate crisis. Amazonia is a key region for banks to introduce bold global policies that can deliver on the intent to uphold human rights, protect biodiversity, and keep global warming to 1.5C. Following International Energy Agency guidance, there should be no new oil and gas production if we want to stay under 1.5C, yet we continue to see bank financing for the expansion of oil and gas in the world’s biggest rainforest.”

Fany Kuiru, General Coordinator of the Coordinator of Indigenous Organizations of the Amazon Basin (COICA):

“Oil expansion in the Amazon is a latent threat to Indigenous territories and vital ecosystems in Peru, Ecuador, Brazil, and Colombia, but also puts at risk dozens of uncontacted Indigenous Peoples whose existence depends on the intangibility of their territories. Combined degradation and deforestation confronts us with an imminent point of no return that, for our peoples, translates into chronic diseases as a consequence of contamination, the loss of our food sovereignty due to heavy metals found in fish and the water we drink, and systematic violence against those who defend our home. The banks, finance companies, and other companies that invest in the region and whose profits are derived from oil exploitation, are accomplices in the death of our leaders, of our cultures and ways of life. We urge the largest bank investors to leave the Amazon immediately.”

Todd Paglia, Executive Director, Stand.earth:

“‘Capitalizing on Collapse’ shows clearly that banks must stop financing oil and gas in Amazonia. The platform for a geographic exclusion (Exit Amazon Oil and Gas) points to one of the pillars in the Amazonia for Life: 80 X 2025 initiative, and is a clear pathway for banks to send the signal that they want to invest in the future of Amazonia, not its collapse. By implementing an Amazonia-wide exclusion for problematic oil and gas investments, exiting deals and relationships that cause destruction, and investing in ecological, Indigenous-supported economic development in the region, banks like JPMorgan Chase, Itaú Unibanco, and Citi can be on the right side of history.”

April Merleaux, Research Manager, Climate & Energy Team, Rainforest Action Network:

“Capitalizing on Chaos” highlights important research on bank finance flowing to oil & gas extraction in the Amazon biome. The surest path to keeping global temperatures under 1.5˚C is to enact principles of FPIC – the Free, Prior, and Informed Consent for Indigenous Peoples. Protecting human rights and keeping fossil fuels in the ground will veer us away from Climate Chaos. But this report shows that banks – including big US banks like Bank of America and JPMorgan Chase – are moving in the opposite direction by financing destruction in this crucial region. “Capitalizing on Chaos” casts doubt on banks’ net zero pledges.